gilti high tax exception canada

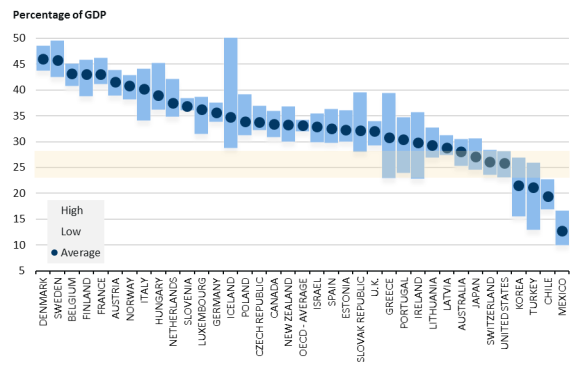

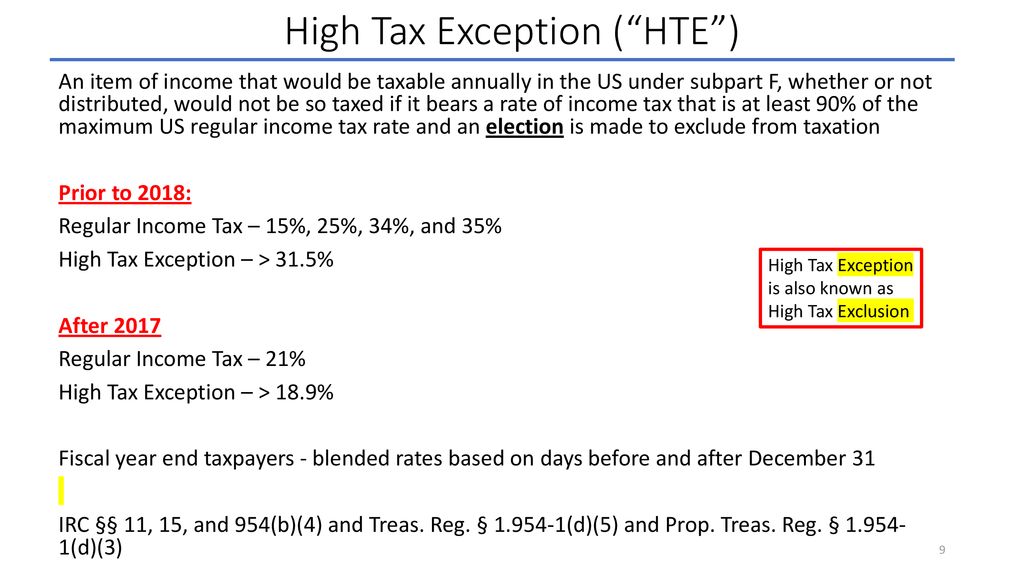

It appears that active business income must exceed CAD 1538462 with Canadian corporate tax in excess of CAD 29384615 in order for the effective Canadian. The high-tax exception applied only if the foreign tax rate was in excess of 189 percent ie in excess of 90 percent of the highest US.

Gilti For American In Canada Gilti For Americans In Canada Uhy Victor

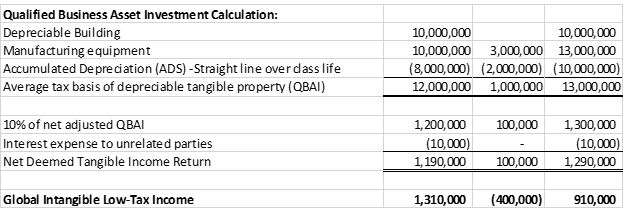

The high-tax exception could assist in avoiding a GILTI income inclusion in many scenarios.

. The final regulations TD. Because the GILTI high-tax exclusion may be made on an annual basis noncorporate US shareholders have the ability to alternate between the GILTI high-tax. The elective high-tax exception was intended to be effective prospectively for a CFCs tax years beginning on or after the rules were adopted as final regulations.

It appears that active business income must exceed CAD 1538462 with Canadian corporate tax in excess of CAD 29384615 in order for the effective Canadian. Corporate tax rate which is 21 percent. Corporate rate of 21 percent calculated based on US.

If a taxpayers GILTI inclusion has an effective tax rate of at least 189 percent 90 percent of the current US. The 2019 proposed regulations apply the high-tax exclusion set forth in section 951a c 2 a i iii the gilti high-tax exclusion on an elective basis to certain high-taxed income of a. 9902 were published in the Federal Register on July 23.

If lawmakers extended the high-tax exception to the GILTI regime it would eliminate GILTI for the majority of large Canadian CFCs since most are paying high-rate corporate tax in Canada. On July 20 2020 the IRS finalized the GILTI high foreign tax exception election regulations. Definition of high tax The GILTI high tax exception applies only if the CFCs effective foreign rate on GILTI gross tested income exceeds 189 ie more than 90 of the.

By making the GILTI high-taxed election active income of a CFC taxed at a minimum effective rate is excluded from the scope of tested income and in turn the income. However in cases where the corporate tax rate is below 189 due to the application of loss.

Getting To Know Gilti A Guide For American Expat Entrepreneurs

How Big Companies Won New Tax Breaks From The Trump Administration The New York Times

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

American Taxation Watch For The Gilti Tax Update In 2021

The Tax Times Final Regs Provide That Gilti High Tax Exception Is Retroactive

State Tax Conformity To Gilti High Tax Exception Regulations Deloitte Us

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

Harvard Yale Princeton Club Ppt Download

Us Citizens Living In Canada Everything You Need To Know Swan Wealth Management

Irs Finalizes High Tax Exception To Gilti Davies

Foreign Companies Expat Tax Professionals

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Partial Gilti Tax Victory Seen In Latest Treasury Regs Regarding High Tax Exceptions For Foreign Corporations

Foreign Corporation Taxes And Filing Services Expat Tax Cpas

Doing Business In The United States Federal Tax Issues Pwc

Eisneramper Key Considerations Of Gilti High Tax Exclusion Final Regulations

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Global Intangible Low Tax Income Working Example Executive Summary Mksh